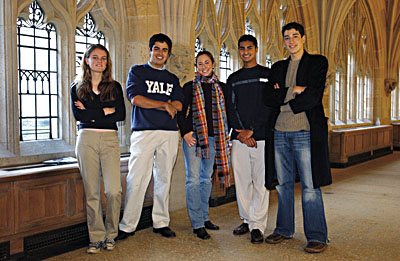

| Members of the new Student Microfinance Initiative help to promote or coordinate projects in five developing countries. Pictured are SMI members (from left) Katherine Meckel '07, Santiago Suarez '07, Shannon Monaghan '08, Ravi Varghese '08 and Carlos Francisco Fernandez '08. |

This semester, a group of Yale undergraduates banded together with a shared devotion to a simple philosophy: "Think big, act small."

They hope to transform -- even revolutionize -- the traditional ways that developing nations conduct financial business by undertaking small-scale projects that ultimately benefit large numbers of people, namely the poor.

Called the Student Microfinance Initiative (SMI), the group is networking with other students around the globe with the goal of making microfinance a long-term, sustainable industry.

The students believe that microfinance -- a host of financial services targeted specifically to low-income groups in both the developing and developed world -- is key to solving the problem of world poverty, says sophomore Santiago Suarez, the founder of the group. Microfinance services include loans, insurance, savings, money transfers and other financial transactions on a small scale. These services, notes Suarez, allow low-income and poverty-stricken people to improve the quality of their lives by becoming self-sufficient.

"Basically, microfinance is about giving poor people access to credit and to financial well-being," explains Suarez. "The SMI's goal is to accelerate access to credit for low-income and poor people." While the Yale organization does not lend money, it focuses instead on educational projects that make it easier for entrepreneurs to obtain financial support. (See related story.)

Suarez started the SMI after working during the summer as a student ambassador for the United Nations Capital Development Fund (UNCDF), an agency that seeks to build inclusive financial sectors that serve poor and low-income people. As part of a two-year project, the UNCDF selected 20 students to represent their home countries in furthering this goal. After seeing the success of some of the student ambassadors in the area of microfinance, Suarez wanted to replicate the program with Yale students and a network of other students in developing countries around the world.

Suarez says that the timing of the new initiative is also appropriate, as the United Nations has just designated the year 2005 as the "International Year of Microcredit" with the aim of raising awareness about microfinance around the world.

"There are about two billion people in the world -- or half the world's population -- who live on less than $2 a day," says Suarez. "But in some countries, such as my home country of Colombia, there is the perception that microfinance is a useless enterprise. One of the goals of the SMI is to help change that perception."

As proof of the value of microfinance, Suarez tells the story of a woman living in a very poor community in India who was given a bank loan of approximately $200 for a computer. She set up the computer at a kiosk and then charged visitors to use it, thus raising the money to pay back her loan. Someone in the village used the computer to send to an agricultural university pictures of crops that had been dying from an unknown disease for decades. An expert at the university immediately recognized the disease and informed the farmer about how it could be alleviated.

"This is an example of how a small loan to one poor woman ended up not only empowering that woman but also had a major impact on the entire community, because the villagers finally learned the solution to a disease that had been killing their crops for about 20 years," Suarez comments. "So the community was empowered with this information. Often, we see how when one person gains, there are collective gains."

Because women in developing countries are often the main beneficiaries of microfinance services, according to Suarez, the microfinance industry also plays an important role in promoting gender equality.

India is one of five developing countries with which SMI has launched projects in the several months since its founding. SMI initiatives are also underway in Colombia, Mexico, the Dominican Republic and Kenya. The group is also in the planning stages of a partnership in Tanzania.

Each of the projects the SMI undertakes is tailored to the individual needs and culture of the specific country, Suarez says. The 15 Yale students who participate in SMI serve on a central committee that coordinates international efforts. In each of the participating countries, there is a committee of students who manage SMI initiatives in their own communities.

"The student committees are at the core of the network," says Suarez. "We believe that local students need to be the ambassadors in their own communities. They are committed to our goals and work with microfinance institutions, non-governmental organizations, prospective entrepreneurs and others to increase awareness about microfinance, do fundraising, and plan and host events."

In Colombia, SMI has partnered with two institutions of higher education -- the Universidad los Andes and Universidad ICESI -- to lobby for changes in the country's financial regulations so that microfinance institutions can operate more effectively there.

"The regulations in Colombia apply mainly to traditional financial institutions," Suarez says. "You cannot lend to people without collateral. But the people who would benefit from microfinance have no collateral -- no car, no house. So we are advocating for regulation change and hoping to change the cultural perception of microfinance there." The SMI students are also planning a microfinance/entrepreneurship fair for the spring of 2005, where staff from Colombian microfinance institutions and local entrepreneurs can meet.

"In Columbia, there are about 10 microfinance institutions, but most of the entrepreneurs don't know these institutions exist," Suarez says.

In Mexico and the Dominican Republic, a committee of students from the National Autonomous University of Mexico and Intec, respectively, are helping with the logistics of the Global Microentrepreneurship Awards (GMA), a UN-sponsored initiative to recognize promising entrepreneurs who have been the beneficiaries of microfinance services.

One recipient of the recently awarded GMA in the Dominican Republic is a woman named Doña Berta, who has been sewing handkerchiefs since the 1950s and was once the sole provider of handkerchiefs to former Dominican dictator Leonidas Trujillo. After he was removed from power, Berta operated her business from a street corner, but with the help of small loans, she has since been able to set up a small factory for the manufacture of handkerchiefs.

Doña Berta and most of the entrepreneurs who turn to microfinance institutions for assistance generally receive individual loans ranging between $50 and $200, Suarez says.

"The beauty of microfinance is that it is a win-win situation," comments the SMI founder. "Doña Berta wins because she gets support from her business that is not charity. The microfinance institution that has lent her money wins because she must pay her loans back at a high interest rate. And the community wins by having this factory, which now employs a small number of people."

With students at the University of Pennsylvania, the SMI is co-coordinating an effort aimed at making business and legal regulations more supportive of the microfinance industry.

Through the SMI, students in Kenya's Strathmore University are helping microfinance institutions there improve their accounting practices so that they will have better access to international capital markets. The students involved in this project are accounting majors, and the microfinance institutions welcome their advice and guidance, Suarez says.

Other SMI projects in the various countries include workshops for entrepreneurs on basic business practices and other topics.

"Many of the entrepreneurs are people who have had no formal education, so for them, learning good business practices has a huge impact," says Suarez. "Knowing such fundamentals can help them increase profit and better prepare them to apply for a loan." In Mexico, M.B.A. students conduct these workshops for free for entrepreneurs.

Most of the foreign students working on SMI initiatives receive course or community-service credit for their involvement. Suarez and other Yale participants in SMI helped to make arrangements with senior officials at the various international schools to introduce the SMI into their curriculum.

"In some of these developing countries, students work full-time while attending school and would otherwise not have the time to devote to our initiatives," Suarez says.

"Mobilizing student support in these countries has been critical because these future leaders will understand the benefits of microfinance and will help to make it a part of their country's economic culture," he adds.

The SMI has recruited private sponsors to help fund its international projects and is currently assembling an international board of advisers that includes School of Forestry & Environmental Studies Dean Gus Speth. Serving as informal advisers to the group are School of Management Professor Christos Cabolis and Yale World Fellow Nachiket Mor, who is the executive director of ICICI, India's second-largest bank.

For Suarez and the other Yale members of the SMI, their work promoting microfinance around the world has made them feel that they are actively engaged in making the world a better place.

"I am interested in improving the quality of life of people living in third world countries like mine," says Carlos Francisco Fernandez, a freshman from La Paz, Bolivia. "I think that through SMI it is possible to take specific actions in order to reach this goal. SMI is not only a dream full of good intentions, it is a project full of energy and achievable goals." Fernandez eventually plans a career in the development sector in his native country.

"I was so impressed when I realized the global scope of the SMI plan that I immediately wanted to be involved," says another freshman, Shannon Monaghan, who is now organizing microfinance fairs in Bogotá

Suarez, who also founded the Yale Economic Association last year and is a member of the Yale International Relations Association, says that the SMI has garnered the attention of the United Nations, which recently provided information about the Yale initiative in informational packets that were passed out at a major international gathering.

"Sometimes we complain about money, but when you look at things from a global perspective, you know that real poverty is a matter of survival," says Suarez. "It's a good feeling to go to bed at night knowing that you are doing something to help improve others' lives on a global level, one step at a time."

For more information about SMI, visit www.sminetwork.org.

-- By Susan Gonzalez

T H I S

Group helping nations understand that microfinance is key to reducing poverty

and Cali, Colombia, which will take place next summer.

W E E K ' S

W E E K ' S S T O R I E S

S T O R I E S![]()

Gift of equipment to further research in engineering

Gift of equipment to further research in engineering

![]()

![]()

Students helping small businesses locally and globally

Students helping small businesses locally and globally Group helping nations understand that microfinance . . .

Group helping nations understand that microfinance . . .

![]()

Area entrepreneurs find funding, support through . . .

Area entrepreneurs find funding, support through . . .

![]()

![]()

In Focus: Yale Medical Group

In Focus: Yale Medical Group![]()

![]()

New center to foster joint study of ecology, epidemiology

New center to foster joint study of ecology, epidemiology![]()

![]()

Death rate rises in urban areas during the time . . .

Death rate rises in urban areas during the time . . .![]()

![]()

Conference and exhibit to explore legacy of Napoleon

Conference and exhibit to explore legacy of Napoleon

![]()

![]()

There's a clash of divas in the Yale Rep's 'The Ladies of the Camellias'

There's a clash of divas in the Yale Rep's 'The Ladies of the Camellias'![]()

![]()

Painter of Chinese themes is named gallery's resident artist

Painter of Chinese themes is named gallery's resident artist

![]()

![]()

Researchers identify a receptor in tick gut . . .

Researchers identify a receptor in tick gut . . .

![]()

![]()

Scientists find link between early gambling . . .

Scientists find link between early gambling . . .

![]()

![]()

Grant funds design of program to keep pregnant women off drugs

Grant funds design of program to keep pregnant women off drugs

![]()

![]()

Study: Family history of alcoholism lowers brain's 'brake' on heavy drinking

Study: Family history of alcoholism lowers brain's 'brake' on heavy drinking

![]()

![]()

Study will test drug's ability to reduce smokers' withdrawal symptoms

Study will test drug's ability to reduce smokers' withdrawal symptoms

![]()

![]()

Memorial service for Osea Noss

Memorial service for Osea Noss

![]()

![]()

Campus Notes

Campus Notes

![]()

Bulletin Home |

| Visiting on Campus

Visiting on Campus |

| Calendar of Events

Calendar of Events |

| In the News

In the News![]()

Bulletin Board |

| Classified Ads

Classified Ads |

| Search Archives

Search Archives |

| Deadlines

Deadlines![]()

Bulletin Staff |

| Public Affairs

Public Affairs |

| News Releases

News Releases |

| E-Mail Us

E-Mail Us |

| Yale Home

Yale Home